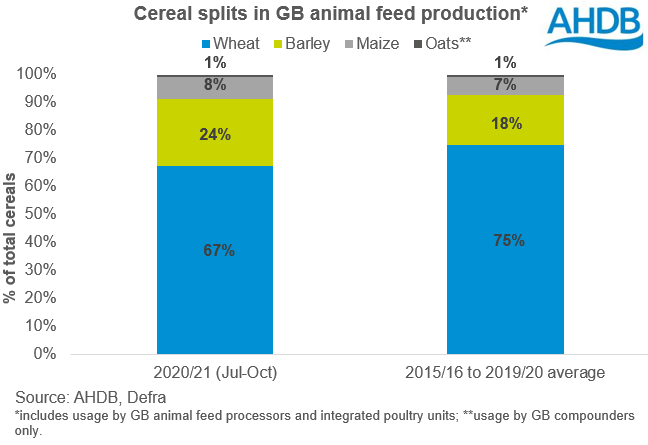

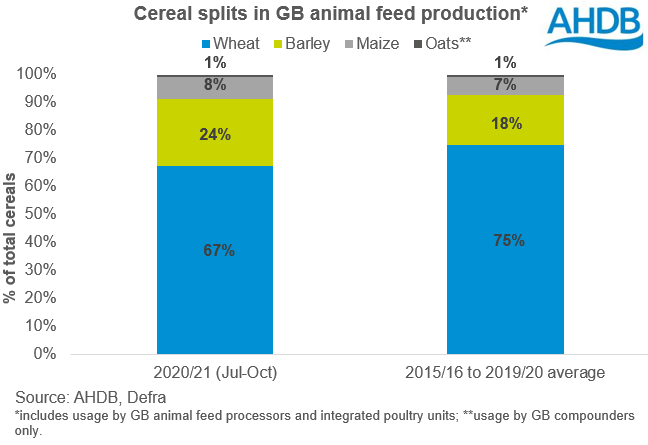

It’s no surprise, with barley at such a discount to wheat, that the proportion of wheat included in GB animal feed production* has shrunk since the start of the season.

Over the past five seasons (2015/16 to 2019/20) around 75% of all cereals used in GB animal feed production* was wheat. So far this season (July to October), just 67% of the total was wheat, with barley inclusions up on the average, currently at 24%.

At the end of last season we saw barley inclusions in animal feed creep up, but reports suggested that barley was being ‘maxed out’ in some rations.

At the end of June 2020 the UK average ex-farm feed barley price was at a discount of around £30/t to feed wheat. This would have been described as significant at the time.

Fast forward a few months and the discount became even larger, touching near £50/t at the end-October. Barley is now at around a £46/t discount to feed wheat (as at 3 December).

With the gap between the two feed grains widening further since the start of 2020/21, we have seen more barley included in rations. As the price of barley is ‘that’ favourable, the proportions of barley used in poultry feed have even increased.

The latest cereal usage data was published last Thursday and gave us information up to end-October. The price relationship between feed barley and wheat has not changed much since then. As such, strong barley usage could have continued in November and is likely to continue in December, if not beyond.

High domestic wheat prices and a very tight supply mean the use of maize in feed rations can’t be over looked. Since the start of the season, the proportion of maize used has crept up slightly too.

Imported maize looked very competitive into certain regions earlier in the season. Despite prices rising quite considerably in recent months, it has been reported that many processors bought maize forward. This means we could see strong inclusions until at least the end of the year.

Beyond 2020

Looking further ahead and with such a tight domestic wheat market and a greater barley surplus, it is very likely that barley inclusions in feed rations will remain strong throughout the season.

Whether maize inclusions continue to be strong very much depends on price. At the moment maize isn’t looking the most competitive into GB, however this could change.

In the latest balance sheets for 2020/21, wheat usage in animal feed is pegged at a multiyear low, while barley inclusions are set to rise considerably. Maize demand in animal feed is currently expected to remain stable on the year.